|

| how to fill new form-15g or form-15h for pf withdrawal |

In this post, we will see the importance of filling the Form 15G or Form 15H and how it saves our TDS (tax deductions) on EPF Withdrawals. Also, we will see to other PF members whether filing a Form 15G/H is compulsory or not.

I urge all PF Members to go through this full article and not to skip any steps mentioned in this post.

Note:

This article is applicable for all those PF Members who are filling their Form 15G / Form 15H on or after April 1, 2021. Because once the financial year ends on 31st March, the new financial year starts on 1st April. So the process of filling the Form 15G or Form 15H changes accordingly.

Form 15G or Form 15H

Form 15G or Form 15H is a declaration form that comes under section 197A (1) and section 197A (1A) of Income TAX Rules, 1962 to be filled by an individual to save TDS (tax deductions) on EPF Withdrawals (Employee Share + Employer Share).

Download Form 15G or Form 15H

- The PF Employees below the age of 60 years can fill Form 15G by downloading Form15G.

- The PF Employees with the age of 60 years and above can fill Form 15H by downloading Form15H.

EPFO Circular for TDS on Payment of PF

- The PF Members can view the Circular released by EPFO for TDS on Payment of PF.

When TDS is not applicable?

- If the employee’s PF Withdrawal amount is less than Rs. 50,000.

- If the employee’s PF Withdrawal amount is more than or equal to Rs. 50,000 with a minimum service period of 5 years.

- If the employee’s PF Withdrawal amount is more than or equal to Rs. 50,000 with a service period of fewer than 5 years. But provided PAN card linked with the EPF Account and also Form 15G/H submitted.

- If the PF amount is transferred from the old PF account to the existing PF account.

- If the employee’s service has been terminated due to the below reasons:

- The employee’s ill health

- The employers business shutdown

- The reason beyond the control of employee

- In case of an employee’s death

When TDS is applicable?

- If the employee’s PF Withdrawal amount is more than or equal to Rs. 50,000 with a service period of fewer than 5 years without linking PAN with EPF Account. The TDS (tax deductions) may go up to 34.608% on EPF Withdrawals.

- If the employee’s PF Withdrawal amount is more than or equal to Rs. 50,000 with a service period of fewer than 5 years. But provided PAN card linked with the EPF Account and Form 15G/H is not submitted. In this case, the TDS will be deducted at 10% on EPF Withdrawals.

How to Fill Form 15G for EPF Withdrawal

Please carefully follow the below instructions to fill Form 15G.

|

| Download Filled form-15g part-1 section1 |

|

| Download Filled form-15g part-1 section2 |

- Click to download -> Form 15G

- Take Print out of Form 15G

- Use a Blue ink pen to fill Form 15G

- Write your name in Name of Assessee (Declarant) field.

- Write your 10 digit PAN number in the PAN of the Assessee field.

- Write INDIVIDUAL in the Status field for EPF Purposes.

- Write your Previous Year. (If you’re filling the form-15G from 1st April 2021 to 31st March 2022, then write Previous Year as 2021-2022)

- Write RESIDENT or NRI in the Residential Status field.

- Write your Flat or Door or Block No in the Flat/Door/Block No field.

- Write if you have Premises Name or leave it blank or dash in the Name of Premises field. (Premises is the piece of land with buildings on it)

- Write the name of your Road/Street/Lane

- Write the name of your Area/Locality

- Write the name of your Town/City/District

- Write the name of your State

- Write the PIN code of your residential area

- Write or leave the Email field blank

- Write your landline or mobile no in field 14 of the Form 15G.

- Fill, ✔️ Yes if you had earlier filed for any income tax returns in the financial year (2021-2022) then mention assessment year (2022-2023) or else fill ✔️No under field 15.

- Write your total PF withdrawal balance (Employee share + Employer Share) to be received under field 16

- Under field 17, before writing anything, you need to add both the estimated income for the financial year (2021-2022) and the amount mentioned in field 16. The addition of both incomes has to be written in field 17. (Make sure your total mentioned incomes within the interest slab rates to save TDS on it)

- In this field 18, if you had filled form 15G in the past you can write the Total No of Form No 15G filed (in no’s i.e 1,2,3 etc) and the Aggregate amount of income for which Form No 15G filed will be the total incomes mentioned in the field 16 while filling multiple Form 15G to save TDS on various income sources during the same financial year (2021-2022). If not leave it blank.

- In this field 19, write PF Number and UAN in Identification number of relevant investment/account, etc. Next, write EPF Withdrawal in Nature of income. later write 192A in Section under which tax is deductible and finally write the PF Withdrawal amount mentioned in field 16 in the Amount of income.

- Required your signature in the Signature of the Declarant.

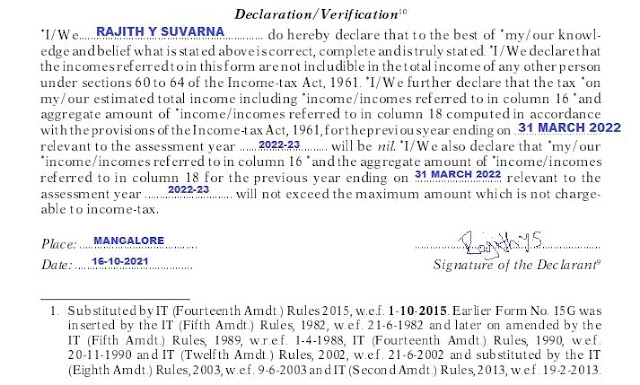

- In the Declaration/Verification section first under I/We write your Name as per EPF records. Next, write 31 MARCH 2022 for the previous ending. Later on, write 2022-23 in the assessment year. Now write the same previous year and assessment year as mentioned above. Finally write your Place, Date and Signature of the Declarant.

- If you don’t have a scanner around you. You can use Kaagaz Scanner App to scan your Form 15G to PDF format.

- Know how to scan your Form 15G to PDF before submitting it to the EPF UAN Portal.

How to Fill Form 15H for EPF Withdrawal

How to Submit Form 15G or Form 15H Online for PF Withdrawal

FAQs related to Form 15G or Form 15H

Q1. What is the purpose of filing Form 15G?

A. The purpose of filing Form 15G is to save TDS on EPF withdrawals or tax deducted on any income sources within the interest slab rates.

Q1. Can I fill Form 15G to save TDS on my PF Pension amount?

A. Not required. Since pension withdrawals are tax-free. The Form 15G can be filled only on the total PF balance withdrawal of a PF member which includes both employee share and employer share.

Q2. Is PF Pension withdrawal amount tax-free?

A. Yes. The tax is only applicable on PF withdrawals with certain conditions applied and not on Pension amount withdrawals.

Q3. What is the difference between Form 15G and Form 15H?

A. There is nothing much difference between Form 15G and Form 15H.

Form 15G is only filled by those PF employees whose age is below 60 years to save TDS on EPF Withdrawals.

Form 15H is only filled by those PF employees whose age is equal to or more than 60 years to save TDS on EPF Withdrawals.

Q4. Can I submit Form 15G without PAN Card?

A. No. To submit Form 15G, PAN Card detail is mandatory.

Q5. Is a PAN card mandatory while submitting Form 15G?

A. Yes. Because while filling the Form 15G. It is mandatory to write the PAN No in Form 15G.

Q6. How much tax deduction is on PF withdrawal without submitting Form 15G?

A. The tax deduction varies on PF withdrawals without Form 15G based on the below conditions:

- If an employee has linked PAN with an EPF account but has not submitted Form 15G, then the TDS rate on EPF withdrawals will be at 10%.

- If an employee has not linked PAN with an EPF account and also not submitted Form 15G, then the TDS rate on EPF withdrawals may go up to 34.608%.

Q7. Who deducts TDS on EPF withdrawals?

A. The TDS on EPF withdrawals is done by the Income Tax Department and not by the EPFO.

Q8. What is the Previous Year in Form 15g?

A. The Previous Year is the current financial year when you are filling the Form 15G.

For Example: If you’re filling the form on or after 1st April 2021, then the Previous Year will be 2021-2022.

Suppose you’re filling the form before 1st April 2021, then the Previous Year will be 2020-2021.

This is because, after the end of March, the new Financial year begins from 1st April onwards.

Q9. What to write in Estimated income for which this declaration field in Form 15G?

A. You have to write only the total PF withdrawal balance to be received which includes both employee share and employer share and not the pension amount.

For Example: If you check your PF Passbook and if you found your Total Balance (as on date). You just need to write the same amount while filling the required field in Form 15G.

Q10. What to write in Estimated income of the P.Y. in which income mentioned in column 16 to be included in Form 15G?

A. In this column you need to combine your estimated income for the particular Financial Year with the estimated income mentioned in field 16 of the Form 15G and write the total in field 17 of the Form-15G.

If your total combined estimated income mentioned is more than 2.50 lakhs or equal to 5 lakhs then your income falls under the income tax slab limit and tax will be deducted at the rate of 5%.

So, to avoid tax deduction it is better to withdraw your PF amount when you are unemployed.

For Example: Let say you have mentioned pf withdrawal estimated income in field 16 of the Form-15G is Rs. 75,000 and your estimated income for the given financial year (2021-2022) turns out to be 1 lakhs. Then you need to write the amount as 1.75 lakhs (i.e Rs 75,000 + 1 lakhs) in field 17 of the Form-15G.

Q11. What is Assessment Year in Form 15G?

A. Assessment Year: Assessment year is the year where first your income is generated for that particular financial year (2021-2022) and will be taxable in the next assessment year (2022-2023). This is the year that comes after the financial year. During this year our total income is assessed and it has been taxed based on the interest slab rates.

For Example: If you had filed the income tax returns in the financial year 2021-2022, then the assessment year will be 1 additional to the financial year i.e 2022-2023.

Q12. Can I fill Form 15G other than EPF Withdrawals?

A. Yes. You can fill separate Form 15G for any purpose to save TDS on any income source provided within the given interest slab rates during the same financial year (2021-2022)

For Example, Raj is making an extra income source from the interest earned from the Bank. But his concern is that TDS is been deducted from that income source. So to save TDS on that income source. Raj has filled the Form-15G.

Q13. How many times I can fill Form 15G in the same financial year?

A. There is no minimum number as such for filling the Form 15G in the same financial year (2021-2022). You can fill Form 15G for different purposes with the intent to save TDS on the various income source within the given interest slab rates.

Q14. What to write in the “Aggregate amount of income for which Form No 15G filled” field in Form 15G?

A. This field no 17 has to be filled in Form 15G only when if you had filled Form 15G once or multiple times in the past during the same financial year (2021-2022) to save TDS on the various income sources within the interest slab rates.

The aggregate amount to be mentioned here is the summation of total income specified in field 16 of previous Form 15G filled during the same financial year. The same should be mentioned in field 18.

Let’s look at the below example to know more about this field 18 clearly.

For Example, Akash has filled his first Form 15G in April 2021 to save TDS on income earned from bank interest and mentioned in the field 16 of Form-15G as 1 lakhs. In May Akash has resigned from the organization. After 2 months of his unemployment. Akash decided to fill form-19 for PF withdrawal. But his PF withdrawal is more than 50,000 with a service count of 3 years only. So to save TDS on EPF withdrawal Akash has filled the Form-15G.

So in field 18 of the Form-15G, Akash has to mention the Total No of Form No 15G Filled is 1 and Aggregate amount of income as 1,50,000 (1 lakhs + 50,000)

Q15. What is “Details of income for which the declaration is filed” in field 19 of Form 15G?

A. Field 19 is used to mention your PF details to save TDS on your PF Withdrawals within the interest slab rates.

Q16. What will be the tax exemption for Senior Citizens?

A. The senior citizen within the age limit of 60 to 79 years will have tax exemption up to 3lakhs. income. The super seniors within the age limit of 80 to any age will have tax exemption up to 5 lakhs.

Q17. Why I am getting an error “Verified PAN not available cannot upload Form 15G”?

A. This error has occurred since you haven’t linked your PAN with the EPF account. In that case, you need to submit two photocopies of Form-15G with 1 copy of your PAN Card to your respective EPFO regional office within 1 or 2 days after submitting the online form. This will save TDS on your EPF Withdrawal income.