|

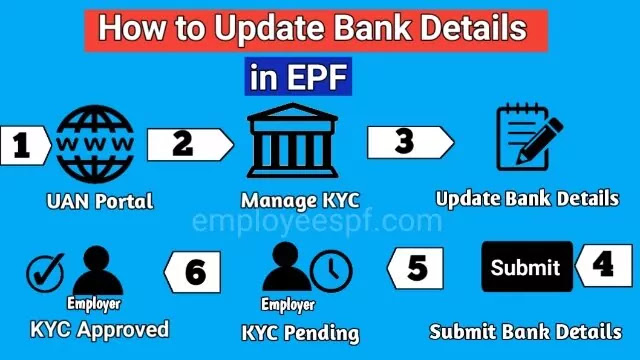

| How to update bank details in epf |

The EPF members other than SBI bank account holders can update their bank details in EPF. But their Bank KYC request will be sent to their respective employers. Once their employers digitally signs and approves their Bank KYC request then only their bank account will be linked with their EPF account.

In the case of other EPF members holding a bank account in SBI bank. Their Bank KYC request will be sent to the SBI bank directly. Once the SBI bank verifies the bank details of the of the PF member. Then the bank digitally signs and approves the Bank KYC.

For SBI account holders, please follow the below link to update bank details in EPF

In this post, we will see how to update bank details in EPF for all the pf members who have a bank account other than SBI.

Note: Please jump to the latest update section provided in this post for any new information regarding bank KYC approval, since EPFO keeps making changes.

How to update Bank details in EPF

Follow the below steps carefully to successfully add your bank account (SBI) in EPF with your Employer’s Approval.

Step 1: Visit EPFO’s Unified Member Portal

Step 2: Enter your 12-digit UAN, Password, and Captcha and click the Sign-in button.

|

| Sign in to the unified member portal |

Step 3: Close the Alert dialogue box.

Step 4: Now go to the Manage menu and under it click on KYC

|

| Select manage KYC for bank KYC in EPF |

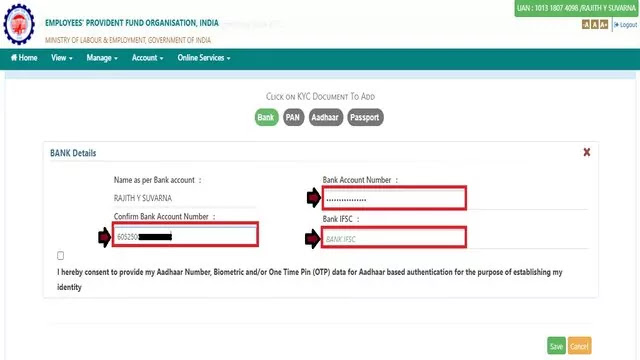

Step 5: Click on the Bank optionto start the Bank KYC process.

Step 6: Under Bank Details, enter your Bank Account Number, confirm the same Bank Account Number and enter Bank IFSC

|

| Enter bank details for bank KYC in EPF |

Note: Bank Account Name will be fetched automatically as per the name on EPF records.

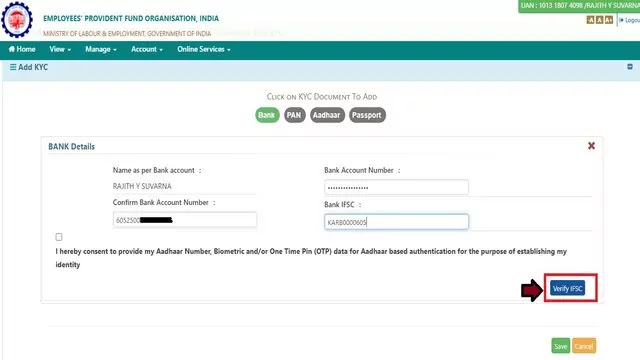

Step 7: Click on Verify IFSC button for Bank IFSC code verification. The IFSC-verified message will appear on successful verification. Click on Ok.

|

| Verify IFSC code for bank KYC in epf |

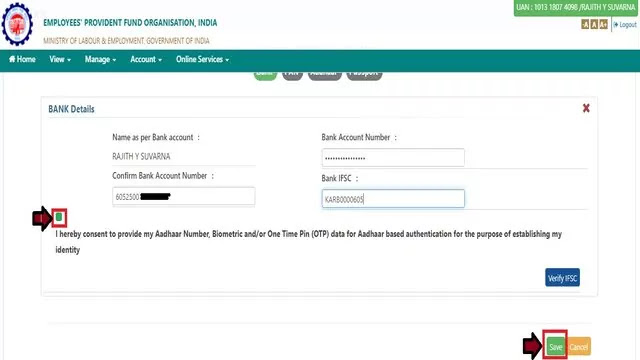

Step 8: Tick the check box for Aadhaar-based authentication based on OTP as your identity proof.

Step 9: Click on the Save button to receive OTP on your Aadhaar-linked mobile number.

|

| Save bank details for bank KYC in EPF |

Step 10: Now, enter the 6 digits OTP received to your Aadhaar-linked mobile number and click on Submit button.

Note: The OTP will be valid only for 10 minutes.

|

| Submit bank details for bank KYC in EPF |

- Now your bank account KYC request will be sent to your employer.

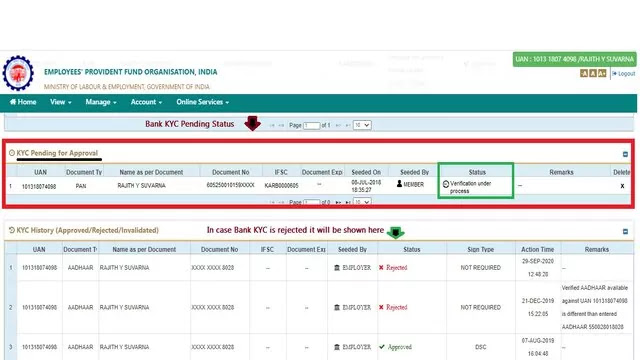

- Initially, your Bank KYC will be in pending status. You can see your KYC Pending status under KYC Pending for Approval column of the UAN Portal.

|

| Bank KYC Pending for Approval by Employer |

The bank KYC will be approved by the Employer based on his/her willingness or availability.

Bonus Tip

- Make sure you do the necessary follow-ups by mail or through call reminding your employer or hr department to approve your Bank KYC within a minimum of days.

Once the Employer approves your bank KYC. You can see your Bank KYC approved status under the Currently Active KYC column of the UAN Portal.

|

| Bank KYC approved in EPF UAN Portal by Employer |

Latest Update

FAQs related to updating Bank KYC in PF Account

Q1. How to update bank details in EPF?

Ans. Follow the above steps to update your bank details in EPF.

Q2. Who will approve my bank KYC in EPF?

Ans. If you’re an SBI account holder then your bank KYC will be approved by the SBI bank or else you’re bank KYC will be approved by the Employer.

Q3. Which bank is better for bank KYC in EPF?

Ans. If you’re an SBI account holder then your bank KYC will be approved by SBI bank and for other bank account holders bank KYC will be approved by the Employer.

Q4. How long will the employer take to approve bank KYC in EPF?

Ans. The bank KYC can be approved by the employer immediately or may take time based on the employer’s availability or other purposes. Make sure proper follow-ups are done with your Employer to ensure bank KYC is approved quickly.