|

| How to update bank details without an employer in epf |

The EPF members who are account holders of SBI and other EPF approved banks can easily link their bank account with their epf account without the approval of their employer. This means that the bank KYC request will be sent to these banks and will be approved by it. Once approved by the Bank, your bank account will be successfully linked with your EPF Account.

New Update: Now along with SBI, Union Bank of India, Canara Bank, HDFC Bank, Bank of Baroda, United Bank of India and Kotak Mahindra Bank account holders too can easily link their bank account with EPF without employer’s approval. The respective banks will approve the bank kyc request and link your bank account with your EPF account.

Note: Please jump to the latest update section provided in this post for any new information regarding bank KYC approval, since EPFO keeps making changes.

In the case of other PF members having a bank account other than SBI, Union Bank of India and Canara Bank, their bank KYC request will be sent directly to their employer for approval. Upon approval from the employer then only your bank account will be successfully linked with your EPF Account.

Let’s see how can we update our bank details without an employer in the EPF account, especially for the SBI, Union Bank of India and Canara bank account holders.

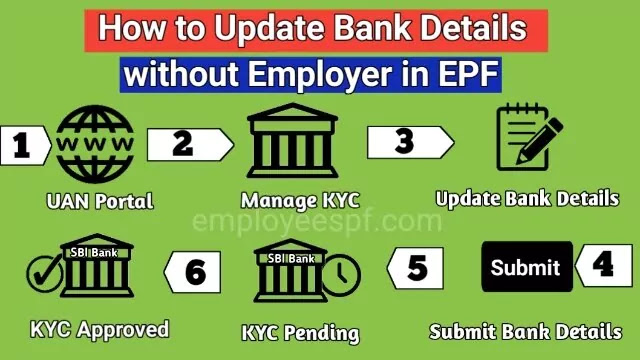

How to update Bank details without Employer in EPF

Follow the below steps carefully to successfully add your bank account (SBI, Union Bank, and Canara) to EPF without Employer Approval.

Step 1: Visit EPFO’s Unified Member Portal

Step 2: Enter your 12-digit UAN, Password, and Captcha and click the Sign-in button.

|

| Sign in to the unified member portal |

Step 3: Close the Alert dialogue box.

Step 4: Now go to the Manage menu and under it click on KYC

|

| Select manage KYC for bank KYC in EPF |

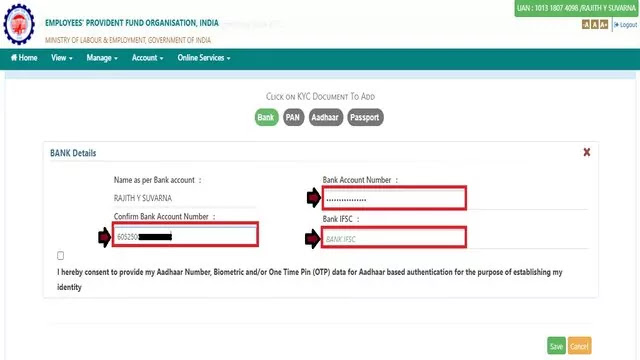

Step 5: Click on the Bank option to start the Bank KYC process.

Step 6: Under Bank Details, enter your Bank Account Number, confirm the same Bank Account Number and enter Bank IFSC

|

| Enter bank details for bank KYC in EPF |

Note: Bank Account Name will be fetched automatically as per the name on EPF records.

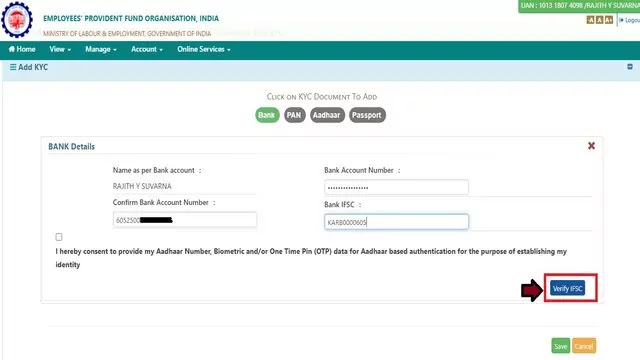

Step 7: Click on Verify IFSC button for Bank IFSC code verification. The IFSC-verified message will appear on successful verification. Click on Ok.

|

| Verify IFSC code for bank KYC in epf |

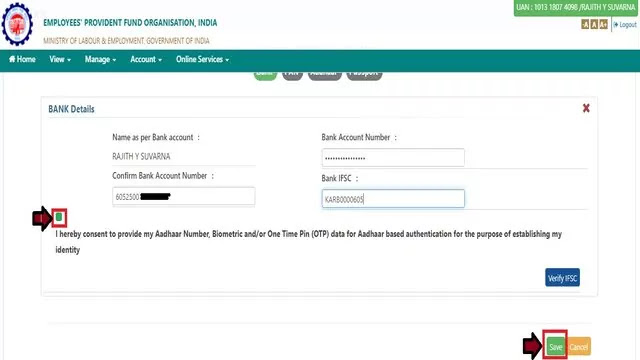

Step 8: Tick the check box for Aadhaar-based authentication based on OTP as your identity proof.

Step 9: Click on the Save button to receive OTP on your Aadhaar-linked mobile number.

|

| Save bank details for bank KYC in EPF |

Step 10: Now, enter the 6 digits OTP received to your Aadhaar-linked mobile number and click on Submit button.

Note: The OTP will be valid only for 10 minutes.

|

| Submit bank details for bank KYC in EPF |

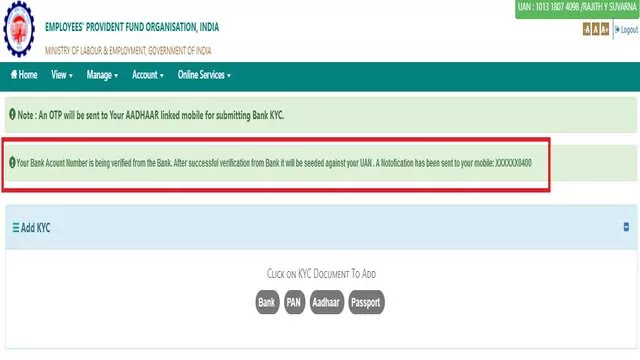

Now your bank account KYC request will be sent to the SBI and other EPF-approved banks. You will be able to see a below-green high lightened message.

“Your Bank Account Number is being verified from the Bank. After successful verification from Bank, it will be seeded against UAN. A Notification has been seeded to your mobile: XXXXXX0400”

|

| Bank KYC notification sent to mobile |

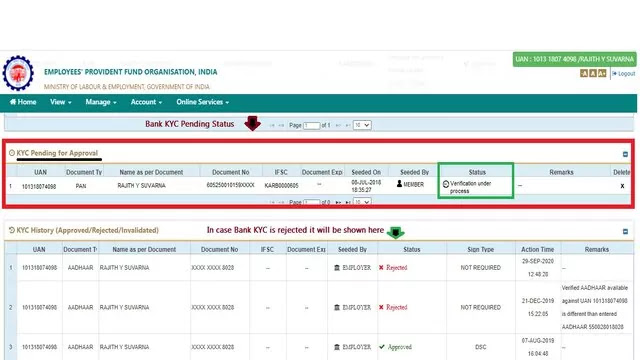

Initially, your Bank KYC will be in pending status. You can see your KYC Pending status under KYC Pending for Approval column of the UAN Portal.

|

| Bank KYC Pending for Approval by SBI Bank |

The bank KYC will be approved by the SBI and other EPF-approved banks within 2 to 3 working days.

Once your bank KYC is approved by the SBI and other EPF-approved banks. You can see your Bank KYC approved status under the Currently Active KYC column of the UAN Portal.

|

| Bank KYC approved in EPF UAN Portal by SBI Bank |

Latest Update

FAQs on updating Bank details without Employer in EPF

Q1. How to approve bank details in EPF without an employer?

A. To approve bank details in EPF without an employer. The PF members must be account holders in SBI, Union, or Canara Bank. Follow the above steps to Update bank details in the EPF account.

Q2. How long it will take to approve bank details in EPF?

A. If you’re an SBI or other EPF-approved bank account holder, then your bank will take 2 to a maximum of 15 working days to approve your bank details in EPF.

But if you’re other than the SBI or other EPF-approved bank account holder then your employer will approve your bank details within 1 to 2 days or may take more time than the expected time based on the employer’s wish.

Q3. What if I use another bank account other than SBI for Bank KYC in EPF?

A. If you’re an account holder other than SBI, then your bank KYC request will go directly to your Employer. Once, you’re Employer approves your pending bank KYC, then your bank details will be updated in the EPF.